Contactless payment technology continues to grow in popularity. At a time when so many are worried about COVID-19 and social distancing, contactless payments have helped reduce direct physical contact in the retail and dining industries.

What exactly are contactless payments? How do they work? Besides social distancing, what other benefits does the technology offer?

As an IT professional, it’s crucial to keep this technology top-of-mind. Read on to gain greater insight into how contactless payments affect businesses and consumers. There are two main types of contactless payments – depending on how customers choose to interface with merchants.

1. In-person contactless payments

For contactless payments to work in brick-and-mortar situations, both sides of a transaction must use payment devices equipped with near field communication (NFC) technology. This wireless technology uses short-range radio frequencies to establish a connection between a customer’s payment device and a merchant’s POS card reader. Think of it like Bluetooth – except that NFC only works over very short distances.

Fortunately, most credit card terminals now come standard with built-in NFC capabilities. It’s also possible to convert existing smartphones and tablets into portable contactless POS terminals by using an NFC-enabled card reader that pairs with a mobile device.

To make a contactless payment, customers need either:

- An NFC-enabled credit card or debit card. A growing number of cards now ship with built-in wireless capabilities.

- A mobile wallet uploaded with credit or debit card details. Most smartphones, tablets, smartwatches, fitness trackers, and other wearable technologies can store mobile wallets.

When a customer is ready to pay for an item or service, he or she waves his or her phone or card across the merchant’s POS terminal. After a few seconds, the transaction is either approved or declined. In most cases, this eliminates the need to enter PINs or sign any printed receipts.

2. Remote contactless payments

Online shopping, in-app purchases, mail ordering, and phone ordering all technically qualify as contactless – neither the buyer nor seller come into direct contact with each other.

In addition, many businesses have now started offering contactless pickup and delivery options. After ordering an item over the phone, online, or through an app, a customer might receive a QR code or confirmation number sent to his or her smart device. When it comes time to pick up or receive the item, that customer can present the QR code for scanning to a delivery person, curbside pickup attendee, or in-store sales member. This code helps to confirm that he or she is the one who originally placed the order.

Regardless of your business or industry, it is likely you can use at least one of the contactless payment options above. Some merchants use a mix – combining eCommerce checkout options for remote customers and NFC-enabled options for in-store shoppers.

Is making the shift worth it for businesses?

The benefits of contactless payments

As already mentioned, health and safety continue to be one of the driving forces behind the growing popularity of contactless payments. COVID-19 has forever changed the way we interact with people, and retail shopping is no exception.

Contactless payments can offer a safer shopping experience – for both customers and employees. Businesses that don’t offer contactless payments risk alienating potential customers and losing sales.

However, there are other factors helping to fuel this payment trend, including:

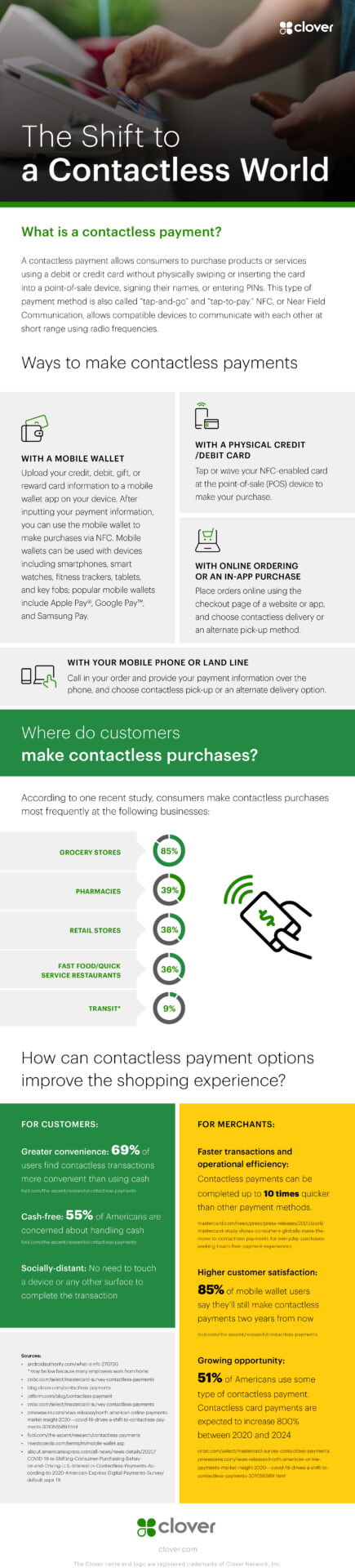

- Convenience: Nearly 70% of American shoppers prefer contactless payments over traditional cash. In fact, more than half of U.S. shoppers report having concerns about handling paper money.

- Speed: Contactless payments are up to 10 times faster than other payment options such as magnetic stripe credit cards. This translates to shorter lines – and by extension – a more pleasant shopping experience for customers.

- Security: For in-person shopping, contactless payments can be safer from fraud. This is particularly true when using a mobile wallet, since customers must unlock their devices and access their mobile wallet apps before initiating payments. In addition to the payment card details being encrypted in the app, many merchants can also employ security methods, such as tokenization and point-to-point encryption (P2PE), to help protect sensitive information during the transaction.

Many of these benefits also extend to merchants:

- Faster transactions can help generate more sales per hour

- Happier customers can translate into repeat business (and word-of-mouth marketing)

- Safer payments help shield businesses from fraud and abuse

Most modern POS readers are already equipped with NFC technology. It’s just a matter of talking to the payment processor to enable contactless payments and remembering to add the decal to the storefront window and next to every checkout counter.

If you have additional questions about how contactless payments work, be sure to check out the accompanying resource created by Clover Network.