The global smartphone market continues its steady rise, showing growth for the fourth quarter in a row. In the third quarter of 2024, smartphone shipments increased by 5% yearly, marking a positive trend for the industry. According to Canalys, a leading technology market analyst firm, this growth has been driven by robust demand in emerging markets and the early stages of a replacement cycle in more developed regions such as North America, China, and Europe.

Apple and Samsung lead the market

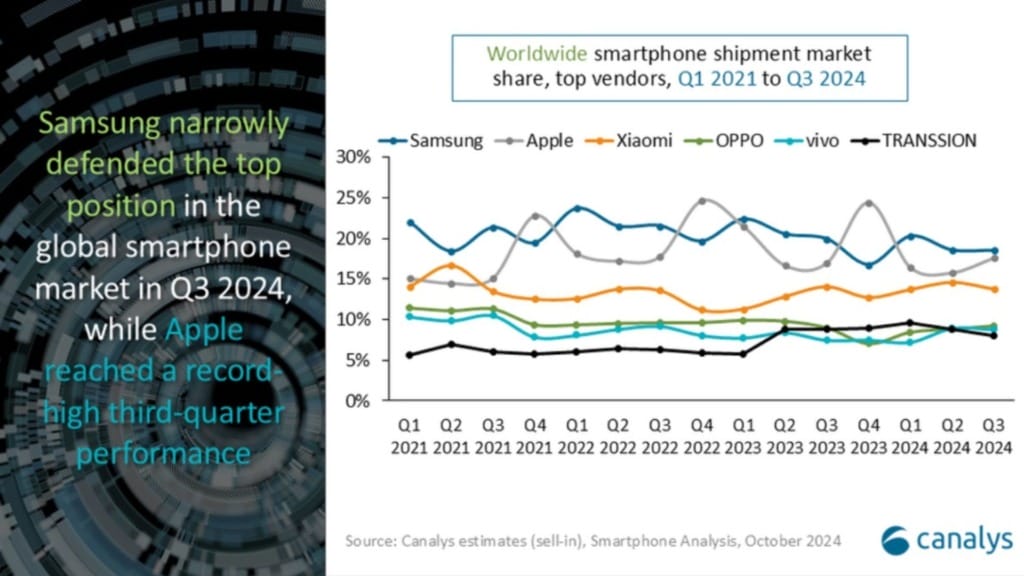

Samsung maintained its position as the market leader, shipping 18% of the world’s smartphones in Q3 2024. However, Apple was not far behind, securing an 18% share, representing its highest Q3 shipment volume. This record performance for Apple was largely fuelled by the popularity of its iPhone 15 range and continued demand for its older models.

Apple’s focus on the premium end of the market is paying off, as consumers increasingly prefer higher-end devices. With strong new and legacy model sales, Apple has capitalised on this shift, helping it secure a close second place in the global rankings.

Competition heats up among top brands

Xiaomi maintained its position in third place, accounting for 14% of smartphone shipments. Meanwhile, OPPO made a strong recovery, reclaiming fourth place with a 9% market share. This success was largely driven by significant growth in India and Latin America, where OPPO’s expanding presence. Vivo completed the top five with a 9% share, rounding out a competitive field of the world’s top smartphone makers.

Canalys noted that the gap between the top five brands is shrinking, and competition is expected to become even fiercer in the coming months, particularly during the holiday shopping season. As consumer demand surges and the market evolves, all major players must stay on top.

Challenges and outlook for the market

While the overall outlook for the global smartphone market is positive, Canalys has also warned of potential challenges. Uncertainty around demand generation and regulatory hurdles in some regions could hinder phone makers. Despite these risks, the market remains resilient, with brands focusing on fine-tuning their strategies.

Canalys stressed the importance of strong supply chain management, maintaining healthy stock levels, and optimising sales and marketing budgets. These factors will be critical for smartphone manufacturers looking to maintain or grow their market share in the months ahead.

As competition intensifies, especially in the premium smartphone segment, the ability to adapt and innovate will be crucial for brands aiming to succeed in this fast-changing industry.