Digital transformation is a trend that all businesses should follow, regardless of size or niche. And we don’t talk only about implementing it internally to facilitate your employees’ work but also your customers’ experience. Nowadays, we can surely say that people are lazier than before and much more demanding when buying and paying for something online. And let’s face it, many products and services offer the same; their branding and user experience are slightly different. With so many options out there, people will usually go for the one that provides them with the smoothest user experience, including the payment phase. You probably have experienced it yourself — adding something to your cart, but you will just give up when you need to go through a tedious check-out and payment process. As a business, you need to address this by facilitating the process for your customers. But also making it easier for your brand to work with your own money. How can you do that? By implementing digital transformation in your payment process.

Modernizing your payment process will be easier than you think. The banking sector is no longer the slow-moving machine it was before because of the revolutionary solutions available now. We can see this positive impact in how people handle their personal finances and how much more flexible some companies are with their funds. When we say “bank” or “banking,” many people will say “oh, no” because, for them, it still means battling with a complicated and unresponsive interface on their bank’s site or app or dealing with representatives, which might take some time and are not always helpful. But this changed because the traditional banking and financial institutions evolved, but also some alternatives are more flexible and offer you more personalized service. We are talking about open banking services, which solve many issues that traditional banking makes us face. This is considered the future of the financial sector since users find them easier to use, and they will become the preferred method to deal with your money and payments. This is why we can see so many fintech companies gain popularity. Such companies called Neobanks offer you the possibility of being more scalable and still guaranteeing your security while facilitating payments.

Many businesses took the first digital transformation steps once the COVID pandemic started, and some of them did it out of need. But after they saw the positive results, they continued down the road and are looking for new ways to continue improving their business. One option is to take the global payments business away from the traditional players and find new ways to facilitate this step of the user journey for your customers. With the help of AI, blockchain, and new products offered by fintech companies, you can find many nontraditional ways to do that. New players offer better payment flows, exchange rates, and flexibility for your company.

With the use of various API solutions of fintech companies, you can guarantee your clients very secure payments, but they can make it in multiple ways. For example, if you would like to offer your services and products internationally, this would mean that you will have to deal with different currencies, which is not always easy when it comes to traditional banking. You usually need to go through different procedures to open accounts, and each of them to be with a different currency. Also, sometimes very high exchange rates will cut your wins quite a lot, and your financial management will become very painful. But fintech companies can facilitate this tremendously. Many of them offer you to open an account in a different currency with just a couple of clicks in their app, the exchange rates are excellent, and the taxes you pay for such exchange are either non-existent or very low. Also, they can be integrated with your site and proceed with the payments in the appropriate currency without any delays. This is perfect for businesses that are just starting their international expansion or would like to be present in many markets and will need to cover a variety of currencies.

Offering your customers the possibility of paying through various platforms is something they will appreciate and perhaps help make you their primary choice. For clients seeing that they can pay not only with credit cards or direct bank transfers is very valuable. Whether it will be PayPal, WePay, Klarna, Buckzy, Revolut, N26, or something else, you will satisfy a bigger part of your customers. And if you offer multiple possibilities, you are increasing your chances of not missing a client that just gets annoyed during the long and hard payment process. Let’s have a look over a couple of trends when it comes to online payments that you shouldn’t miss the opportunity to take advantage of:

- QR-code payments — QR codes are gaining more and more popularity. They became a primary way for people to download a menu in a restaurant, download an application, signup for an event, etc. So, why not use them to initiate payments as well? You can create QR codes that can be added to your commercials if someone would like to get your product even without visiting your site. Or you can generate unique QR codes which will hide behind it all details for a purchase, ways to pay, delivery tracking, etc.

- Pay by link — This is another option to offer payment outside of your site. You will create a personalized link that you will send to your customers, and then they can choose how to pay depending on their preferred payment method. You can send those links via emails, SMS, text messages, and other messaging platforms. This is becoming a popular way for businesses offering different services, for example, hairdressers, to initiate payment even before the person comes to the salon.

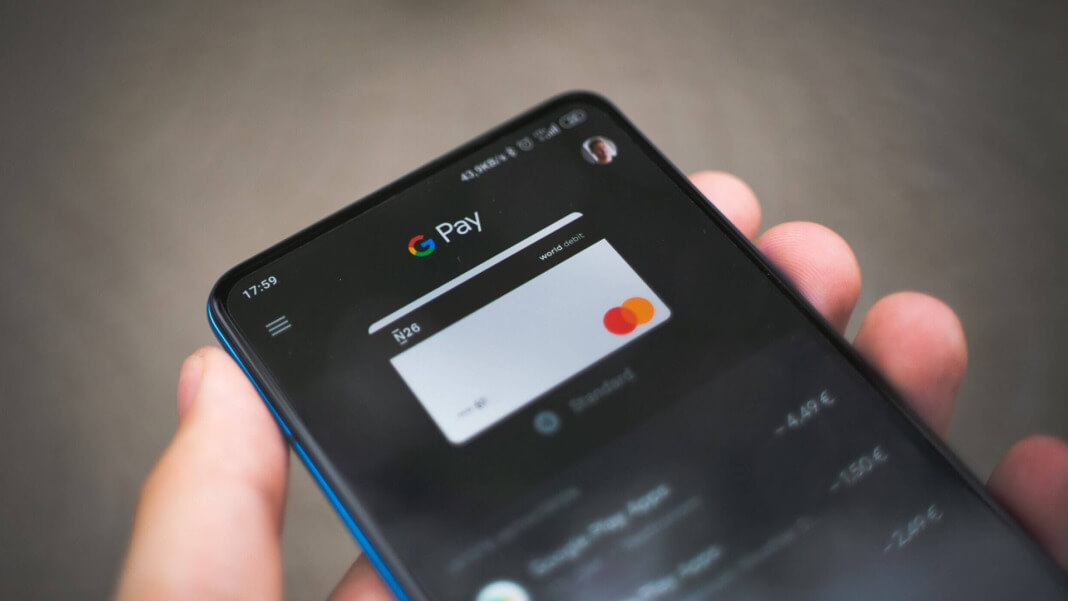

- Digital wallets — Allow your customer to create a digital wallet on your site or platform. In this wallet, they can put their credit and debit cards or other means of payment you support. On top of that, they can collect their points or discounts for their next purchases. If you don’t want to build something like this on your own, you can allow the usage of Google Pay or Apple Wallet, which will be more or less the same for your customers.

You can also consider adding a buy now, pay later (BNPL) option, such as with Atome and hoolah, to your payment methods or such a payment option in general. Many retailers allow people to receive their goods first, check them out, return something if they want, and pay only for what they will keep. When a customer compares you with a competitor, such an option might be a winning point for you. This works great in combination with the variety of payment methods. Because once your customer decides which items they will keep, they can just click again on, let’s say, their payment link, choose the method they like to play with, and the money will be on its way to you. Sounds easy, right? And it is with the help of companies working with the open banking framework. They can offer you various services that will facilitate how people make payments and how you work with your own money as a business. You can have accounts in different currencies but take advantage of easier transfers with better fees, better exchange rates, benefit from more flexibility, receive money faster, if not instantaneously, in your account, and much more. The digital transformation in the financial sector has already started, and we should say that there is for sure much more to be seen. Start exploring how you can make this an advantage for you as a business and your customers.