As experts predict that the fight against the COVID19 global health emergency will persist beyond the previous SARS pandemic, countries all over the world are looking into measures in hopes to find a balance of protecting their citizen’s livelihood as well as supporting businesses via a myriad of fiscal policies. Regardless of the variance in countries’ approach to either flattening-the-curve or relying on herd immunity, activities of daily living would see a fundamental change as restrictions are put in place to curtail the spread of COVID19.

Specialists in the immunology and infectious diseases field agree that immunity to the virus will be central to whether the world is able to shift to a new normal. However, this would depend on two factors – whether there will be enough people who develop immunity, and whether the effect is long-lasting.

With restrictions primarily aimed at social-distancing measures and low-contact interactions, consumer behaviour would naturally see a drastic shift as once crowded streets/malls remain eerily underpatronized. As long as the current situation prevails, such conditions would be a common but uneasy sight for businesses especially in the retail sector who are heavily reliant on healthy footfall in shopping districts.

In Asia, Singapore and Japan have been identified as having had the worst economical impact as a result of the pandemic. Particular to Singapore, the retail sector reported negative sales at -13.3% in March 2020 – the lowest the country has seen in 22 years.

Lee Ju Ye, an economist at Maybank Kim Eng, shared that this could be a result of circuit-breaker restrictions and “because consumers are now avoiding expenditure on discretionary items such as watches and jewellery, cosmetics, recreational goods and apparel and footwear, as the economy enters recession and labour market worsens.” In comparison, the Global Financial Crisis saw the industry’s sales decline at -12%.

Despite the bleak statistics, there are opportunities that businesses can leverage on. At the global level, there has been an increase in the adoption of digital sales channels, with roughly 86% of novel users being satisfied with digital practices, and approximately 75% will continue to carry out online purchases post-COVID19.

Similarly, the APAC region’s increase in smartphone sales penetration, as well as the increase in e-commerce adoption rates is a good indicator on how businesses can capitalize on e-payment opportunities if they want to stay relevant. To add, considering how actions that were once harmless such as handling physical cash can be a driver of virus transmission, digitalizing the payment processes should be placed as a high priority for business owners.

To support the accelerated rates of adoption of e-payment methods, research by Mckinsey reports that the retail sector is set to face 5 long-lasting major trends post-COVID19:

1. Shift to online and digital purchasing

– Online spending is fuelled by movements restrictions, heightened consumer anxiety regardless of age-group. This is likely to last as long as the pandemic continues.

2. Healthy, safe and local.

– Across every level of the supply chain, keeping employees and customers safe during the crisis represents a major challenge for retailers. Those whose operations demonstrate an exceptional low-touch/touchless experience would have an edge due to the low risk of infection. With attitudes toward healthy living on the rise along with a preference for fresh food, a shift to local produce is expected.

3. Shift to value for money.

– Consumers will look beyond pricing in their purchasing decisions and place emphasis on how much value the product can deliver (ie promotion strategies).

4. Flexibility of labour.

– The ensuing consequence of resource and talent scarcity would encourage the need for channelling labour to a wider range of responsibilities.

5. Loyalty shock

– With products in short supply, the increase of new entrants can potentially sway loyal customers buying behaviours. Particularly in Asia and the US, consumers now prioritise convenience in terms of distance, availability, user-friendliness as well as safety measures.

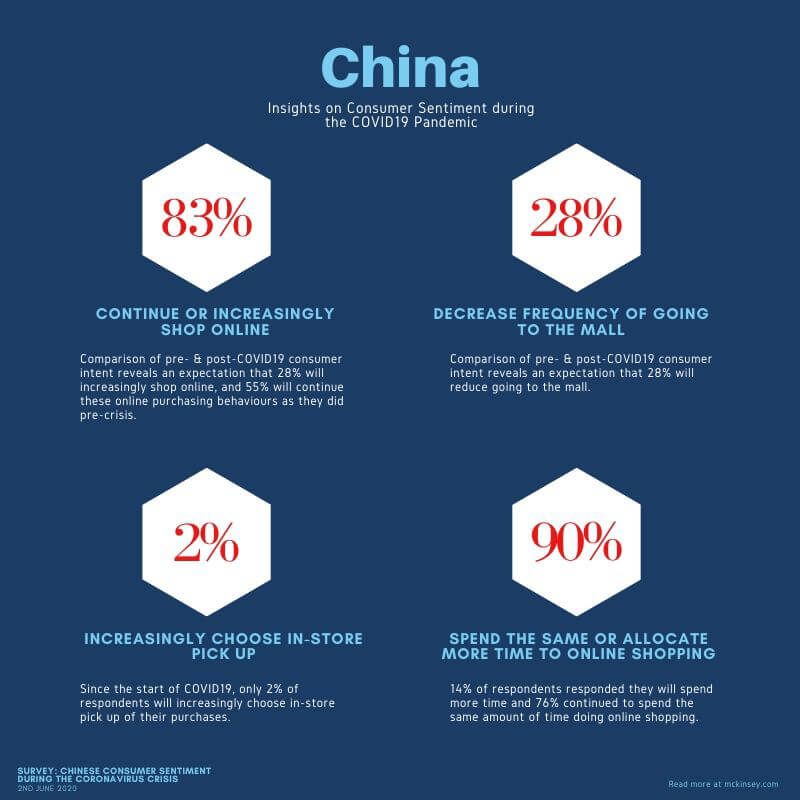

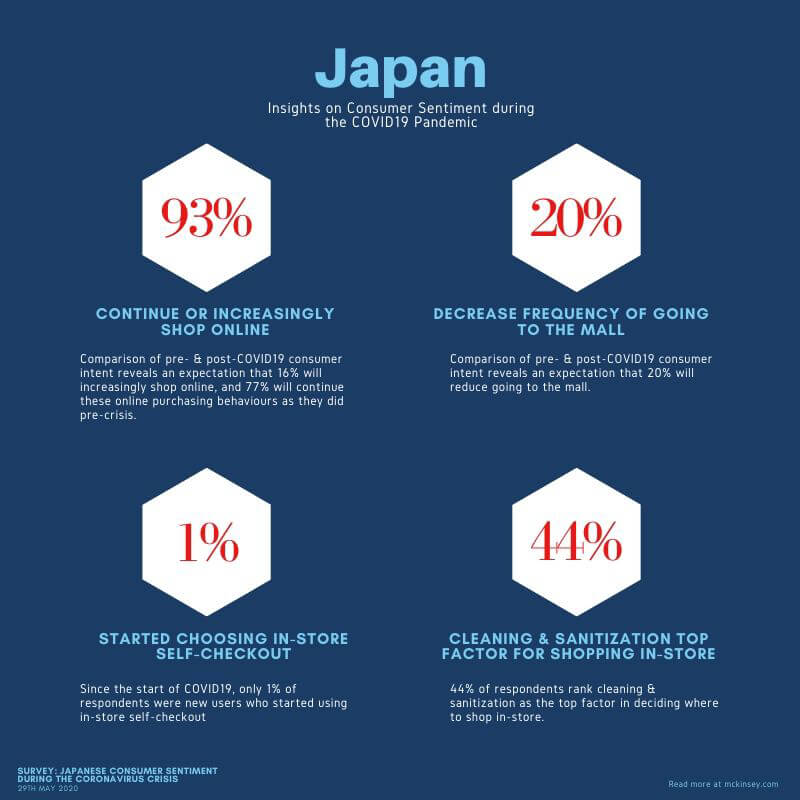

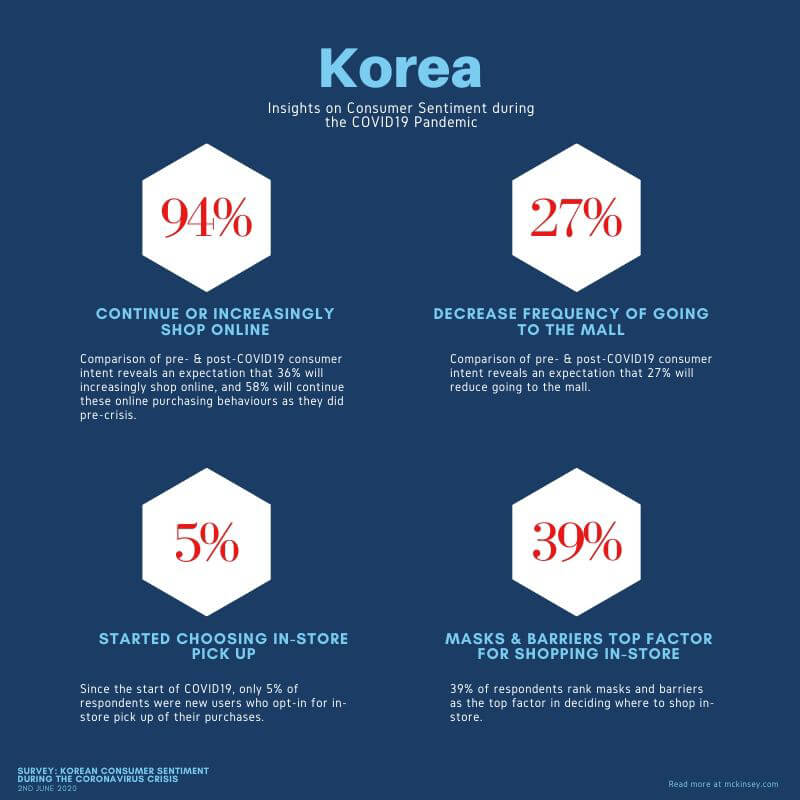

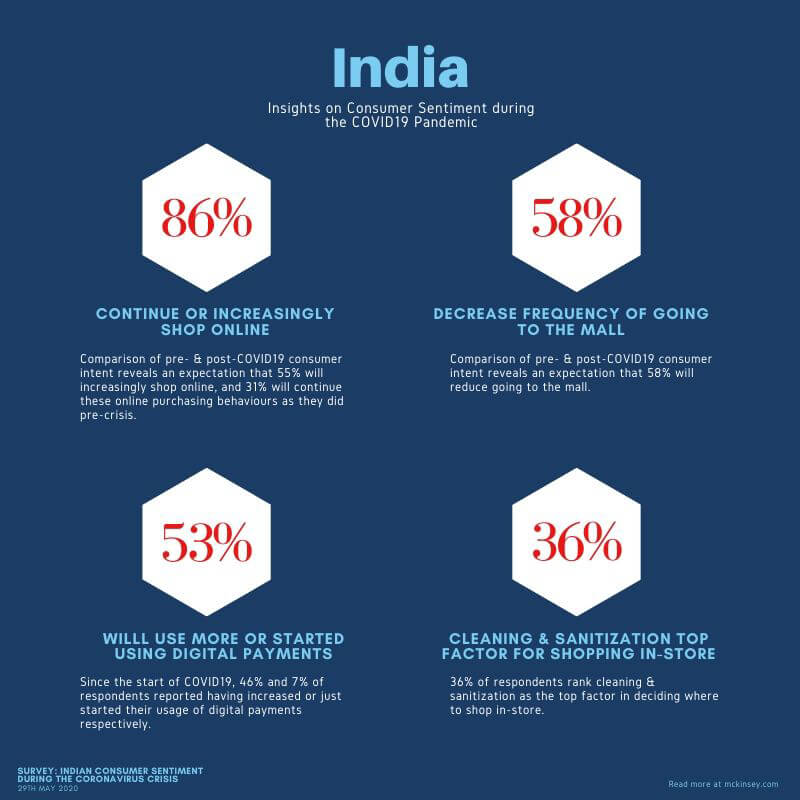

In addition to the five trends, the consulting and strategy firm conducted surveys across various regions and the following infographics provide a quick summary of key consumer attitudes in APAC at the time of the coronavirus pandemic.

Given the resurgence of cases in some Asian countries post-lockdown, it would be shortsighted for retail businesses who rely on conventional brick-and-mortar models and those who solely operate on the storefront basis to continue to do so. As the above trends and statistics have shown, the future is digital, and companies should adapt with haste.

![Getting to know TikTok users [Infographic]](https://www.techedt.com/wp-content/uploads/2020/06/Getting-to-know-TikTok-users-1068x458.jpg)