Retail sure has come a long way from brick-and-mortar stores. Retail has rapidly adapted in accommodation to the shift in consumer needs. COVID-19 has hastened the transition of physical stores to online retail which is no surprise as retailers continuously strive to woo shoppers and cater to their changing behaviours and demands. Technology has been a game-changer for retailers – creating efficiencies, cost-saving and providing better products and services such as the use of social platforms, increased convenience and all the while keeping shoppers safe. These additions give retailers an edge in today’s world. Traditionally, retail expansion meant the physical growth of outlets into the Western market. Today? It’s e-commerce. The e-commerce market is estimated to reach US$2,401million in 2020 and with an expected Annual Growth Rate of 12.1% by 2024.

Here are some strategies on how to thrive:

Evolve value proposition

Retailers have to ensure that their value proposition meets the fast-evolving needs of their customers. Some examples would involve increasing convenience in response to urbanisation and dual-income households. For instance, sale of workout equipment and bubble tea peaked during COVID-19. As consumers tighten their purses during this pandemic and economic situation, retailers could benefit from hosting promotions and offers. Or even partner with third-party agencies, such as Grab, to meet the increasing demand for personalisation and increase outreach.

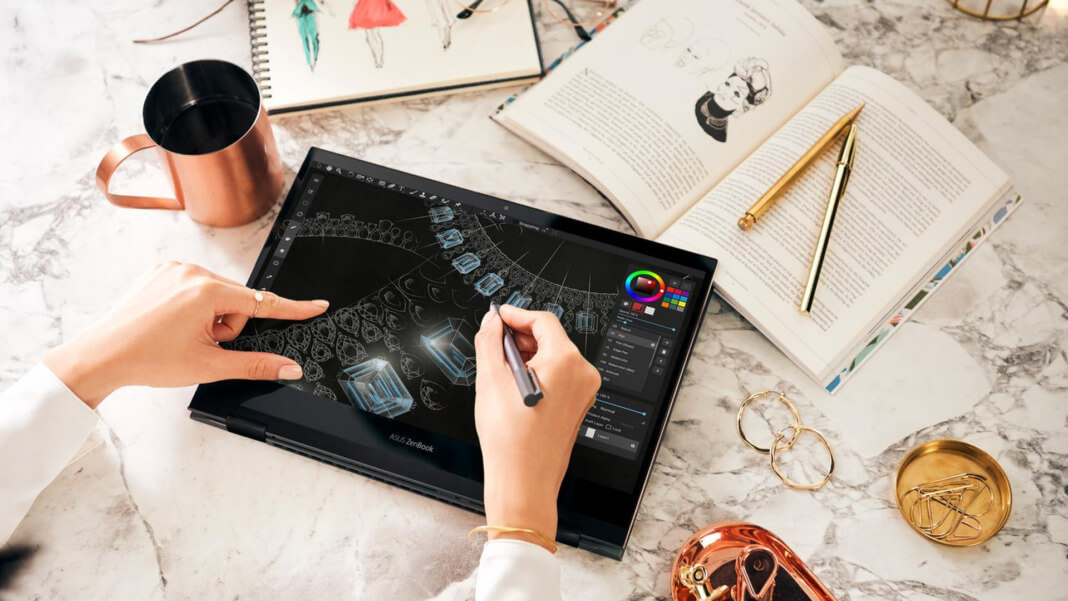

Digital engagement

Digital engagement and value proposition are complementary to each other, especially with online shopping done mostly through mobile phones. However, the path to purchase is fragmented due to the rise of multiple applications and the integration of services. More are making purchases through not only super-apps such as Grab, WeChat and KakaoTalk but e-commerce through social media platforms such as Instagram, Taobao live streaming and short-form video app Douyin and TikTok. 8 out of 10 millennials are shopping online weekly. Instagram itself has already won half the battle in the mobile society that we live in today. Millennials and Gen-Zs make up for the majority of Instagram users. They would be the most appropriate audience group to focus on because of their ever-growing careers and increasing buying power. They are the consumers of the future.

Digital engagement via social media can be used for research, beyond its function as a purchasing tool. Retailers will be able to not only gain insight into consumer behaviours but to observe the effectiveness of their social media formats and adapt them to suit the preferences of online consumers. And of course, without saying, a great user experience online. Retailers have to ensure that their websites are user-friendly, has a convenient navigation system and up to date with the expectations of online consumers. Additionally, website aesthetics would be a plus and provide a more pleasant experience for online consumers.

Futureproof operations

Why invest in physical space when e-commerce is growing so much faster? Prices and rental of retail space for Singapore went up 1.8% and 2.3%, respectively, in the 4th Quarter 2019, which is significantly more than the quarters before. Consumers seem to be spending more on food and less on shopping, and this includes tourists. Selling space per capita isn’t dead, but it is not thriving as well as e-commerce does and especially given the climate that we live in today with social distancing measures which would most likely be a new norm of the future. Rising costs and declining sales density is unsustainable. These old formats would either need to be tweaked or altogether abandoned. Stores today are transitioning towards showroom functions or self-collection hub paired with automation technologies to reduce labour costs.

An example would be those self-checkout stations found in supermarkets with that scan-and-go technology. Retailers will have to scour their cost base for savings and of course moving to a zero-base cost, an ideal. With a zero-base cost, more resources can be invested in technology that would enable a boost in operations and helps create a better customer experience.

Last-mile and supply chain

It is all about faster and cheaper delivery these days. With Asia, there isn’t a one-size-fits-all model due to varying factors such as the demand of e-commerce, urban density, market dynamics, labour costs and logistical maturity. Retailers will have to consider these factors and tailor their last-mile approach to best fit local conditions. With the world inching closer and closer to technology, retailers will too need to anticipate future trends and how they might shape last-mile economics and keep up with developments that make investments in automation possible. All the whilst staying attuned to shorter, local and more automated supply chains as companies strive for greater resilience in the aftermath of COVID-19’s destructive wake.

Ecosystem destination

Companies such as Alibaba and Tencent are ecosystem pioneers. These players disrupt retail value chains by providing B2B services through the means of their scale and capabilities. Some of these services include wholesale services, logistic services, payment propositions or data analytics services. Companies have been rising you the challenge in nurturing their very own ecosystem — for example, Korea’s Kakao and Naver or even Singapore’s Grab. Ecosystems have significantly strengthened during this pandemic where traditional retailers are pushed towards digital retooling and sought out ecosystem partnerships. These alliances can offer retailers capital-light business model and access to fast scaling opportunities that they might not have the time nor resources to build internally. In return, traditional retailers give the ecosystem player access to a physical network.

Without saying, cover the bases. Retailers will also have to take into consideration if the disruption and maturity levels of a country have the potential to be primed for digital acceleration