Paidy is a Japanese fintech startup that allows its clients to make online purchases without credit cards. Yesterday, it announced that it had acquired US$48 million in a Series C extension from one of the largest Japanese trading companies, ITOCHU.

Paidy now says that it has raised a total of US$281 million in debt and equity. This investment from ITOCHU was equity funding. Previously, ITOCHU had participated in Paidy’s Series B and C rounds, which brings its total investment in Paidy to US$91 million. ITOCHU stated that it did an extension instead of moving to Series D so that it could issue a similar type of preferred shares.

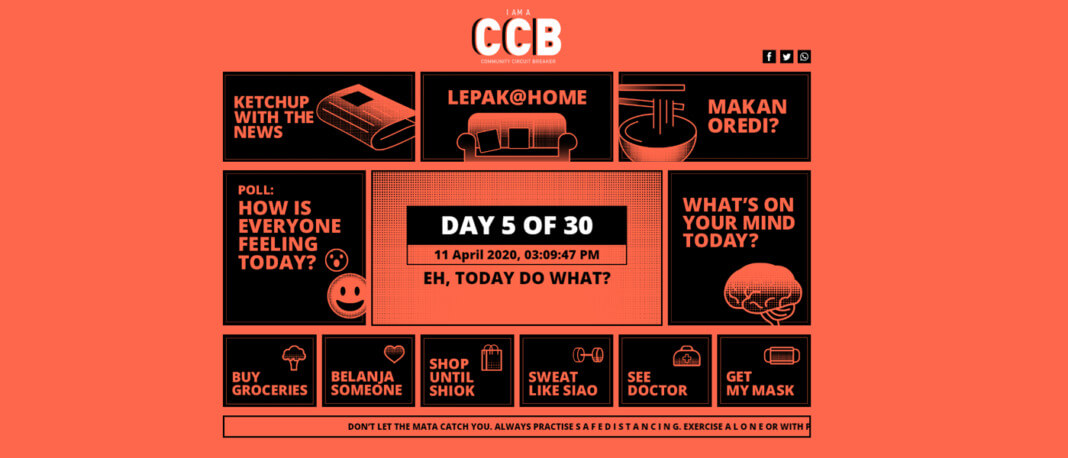

The last Paidy funding announcement was in November 2019, which had investors from PayPal Ventures. This latest funding from ITOCHU will be used to balance its balance sheet during these tough times amid the COVID-19 pandemic. The acquired fund will also be used to support a service that will launch later this year, “buy now pay later.”

Paidy’s payment service allows its users to make online purchases, then pay for the purchases each month with a consolidated bill. It uses proprietary technology to underwrite transactions, score creditworthiness, and guarantee payment to merchants.

Since there are a lot of Japanese consumers who use credit cards for online purchases, Paidy’s service can help the vendors increase their repeat purchases, average order bills, and conversion rates.

A state of emergency was announced in Tokyo and the other six prefecturesin Japan due to the COVID-19 pandemic leading to a decline in spending on hotels, travel, and large-ticket items. However, Paidy says that the use of their service has increased as more people are now buying essential goods online.

The executive officer & executive president of ITOCHU’s Financial Business and ICT, Shuichi Kato said in a statement, “We strongly believe that they will keep playing a critical role in our retail finance strategy as their one-of-a-kind credit examination has been creating a new type of trust, appealing to a wide range of customers. Paidy has also proved that they are capable of implementing prompt solutions in the inevitable battle against fraud, evolving their services to the next level.”