The Italian Trade Agency (ITA) celebrated the next wave of Italy’s fintech innovators at the Global Startup Program Demo Day, hosted at the Marina Bay Cruise Centre. Part of “Villaggio Italia,” an exhibition accompanying the Italian Navy’s iconic vessel Amerigo Vespucci on its world tour, the event demonstrated Italy and Singapore’s shared vision to establish a prominent fintech hub in Southeast Asia.

Against the symbolic backdrop of the Amerigo Vespucci, a historic ship representing Italy’s rich heritage and modern ingenuity, the Demo Day highlighted the strategic cooperation between Italy and Singapore to bolster fintech innovation. The Demo Day was a key feature of the Global Startup Program, a collaborative initiative between the Italian Ministry of Foreign Affairs and International Cooperation and the ITA, aimed at accelerating Italian startups into international markets. Now in its fifth year, the programme has chosen Singapore as a regular partner, hosting the Demo Day here for the third time and further solidifying Singapore’s role as a gateway for Italian companies into Asia.

Italy’s commitment to fostering startup innovation

Opening the event, Italy’s Deputy Minister for Enterprises and Made in Italy, Mr Valentino Valentini, emphasised Italy’s commitment to supporting its startup ecosystem. “Our Ministry recognises startups as a unique sector,” he stated. “We’re focused on creating vibrant environments that allow ideas to become products.”

Mr Valentini highlighted Italy’s dedicated innovation hubs, designed to support emerging startups. These hubs serve as spaces where startups can showcase their activities and access vital resources for growth. He further announced that the Italian government is advancing new legislation to bolster early-stage ventures, addressing challenges in a way that encourages entrepreneurship and actively supports it through structural reforms. “Having innovative ideas isn’t enough; startups need institutional and investor support to turn ideas into reality,” he noted.

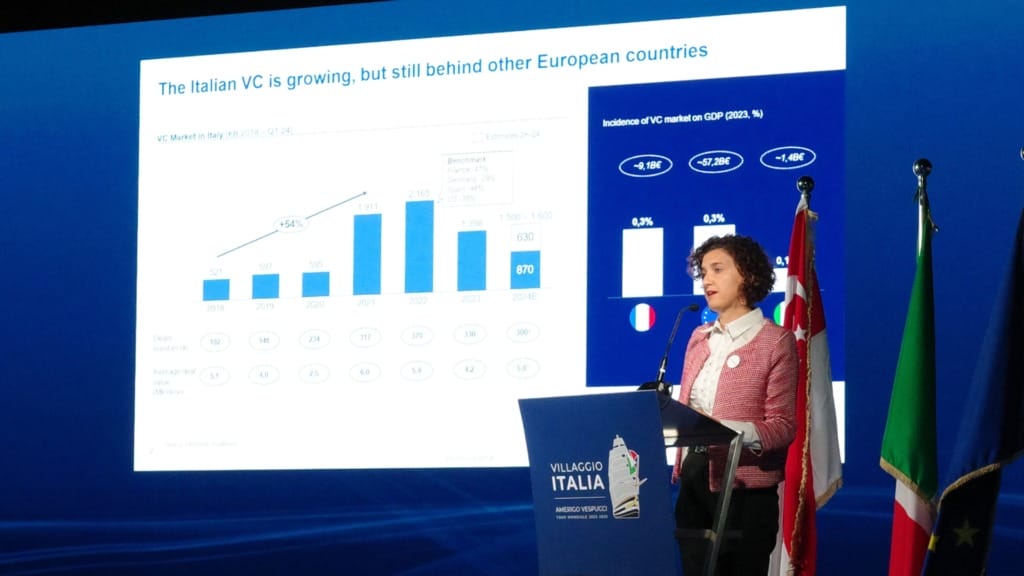

Addressing Italy’s traditional reliance on family-owned businesses rather than venture capital, Mr Valentini acknowledged that Italy has sometimes struggled to cultivate high-risk entrepreneurial ventures. “People often point out that Italy doesn’t spend as much on venture capital compared to other nations,” he remarked. “But those here today are breaking those barriers,” applauding the startups for their ambitious drive to reach global markets.

Italian fintech startups demonstrate pioneering solutions

The Demo Day, organised in collaboration with Singapore-based pre-seed investor Tenity, brought together various stakeholders, including venture capitalists, banking professionals, and fintech industry leaders. ITA’s Director in Singapore, Giorgio Calveri, underscored the significance of this collaboration. “A strong partnership between Italy and Singapore is pivotal for putting our fintech startups on the global map,” he said. “We are immensely proud of the talent and innovation coming out of Italy, and today’s event offers a glimpse of how these startups are not just future players but leaders in the world of financial technology.”

This year, six Italian fintech startups representing sectors from digital assets to SaaS and financial management participated in the Demo Day, each presenting unique solutions that push boundaries in payments, data-driven management, and customer experience. Among the featured companies was Appeaty, founded by Ernesto, an app designed to streamline dining for tourists and locals facing language barriers. “Appeaty enables restaurants to go digital, accommodating language preferences, allergens, and dietary restrictions in just three clicks,” Ernesto explained, noting the app’s capacity to reduce food waste and improve service efficiency.

Another standout was Finanz, a financial “super app” co-founded by Matteo Spreafico, that simplifies personal finance through a fun and educational platform. “Personal finance can be intimidating, and many people lack the resources to manage their finances effectively. Finanz provides tailored education and investment options, all within an engaging app,” Matteo shared. Finanz has experienced organic growth with over 15,000 downloads, and is currently raising $1.5 million to evolve to meet the next generation needs.

Hercle Srl, another innovative participant, offers a platform that allows seamless access to digital asset liquidity, designed to simplify and secure transactions for clients dealing with digital currencies. Similarly, Twiper Srl showcased a generative AI tool for companies to customise chatbots and digital assistants tailored to user needs, from customer support to task management. According to Twiper’s founder Giulia, “Our conversational AI goes beyond traditional bots, making decisions and acting based on user interactions, creating highly functional and efficient support for businesses.”

Completing the line-up was Startgram, a platform that automates investment rounds, cap tables, and incentive plans for startups, and Volvero, a blockchain-based vehicle-sharing app. These startups are receiving tailored support through the programme, including access to networking events, industry masterclasses, and one-to-one sessions with investors, facilitated by Tenity’s extensive network within the Singaporean fintech ecosystem.

Finnley Lee, Head of Operations at Tenity, shared that the Global Startup Program helps startups connect directly with the local ecosystem, enabling valuable introductions to corporates, investors, and stakeholders. Tenity has been instrumental in supporting Italian startups since 2019, offering guidance to help them succeed in Asia. Finnley emphasised the programme’s immersive approach, noting, “Face-to-face interactions are key in Asia, and through our network, startups gain critical insights for successful expansion.”

Deepening fintech cooperation between Italy and Singapore

Italian Ambassador to Singapore, Dante Brandi, reflected on the strategic significance of the partnership, commenting, “Singapore, as a leading innovation hub, offers an ideal gateway for Italian startups to grow and thrive in a competitive global market.” In 2023, Italian exports to ASEAN reached €9.6 billion, and the collaboration provides Italian companies with direct access to one of the world’s most dynamic fintech markets. Ambassador Brandi also mentioned a Memorandum of Understanding (MoU) signed last year between the Singapore Fintech Association and Italy’s AssoFintech, reinforcing both nations’ commitment to fostering fintech innovation.

The Demo Day concluded with remarks from Dr Laura Alexandrini of CDP Venture Capital, Italy’s largest venture capital fund, which supports startups across all business stages. “CDP’s mission is to develop Italy’s startup ecosystem,” Dr Alexandrini noted. She highlighted that the Global Startup Program reflects Italy’s dedication to expanding its fintech footprint globally, with Singapore playing a vital role as a strategic partner in connecting Italian businesses with Asia’s fintech markets.

As the Global Startup Program continues through 8 November 2024, participating startups will engage with key influencers and corporations in Singapore, attend the Singapore FinTech Festival, and take advantage of extensive mentorship and exposure opportunities. The programme’s collaborative approach, combining Italian innovation with Singapore’s supportive business environment, signals a promising future for Italy and Singapore as they work together to shape the next era of fintech innovation.