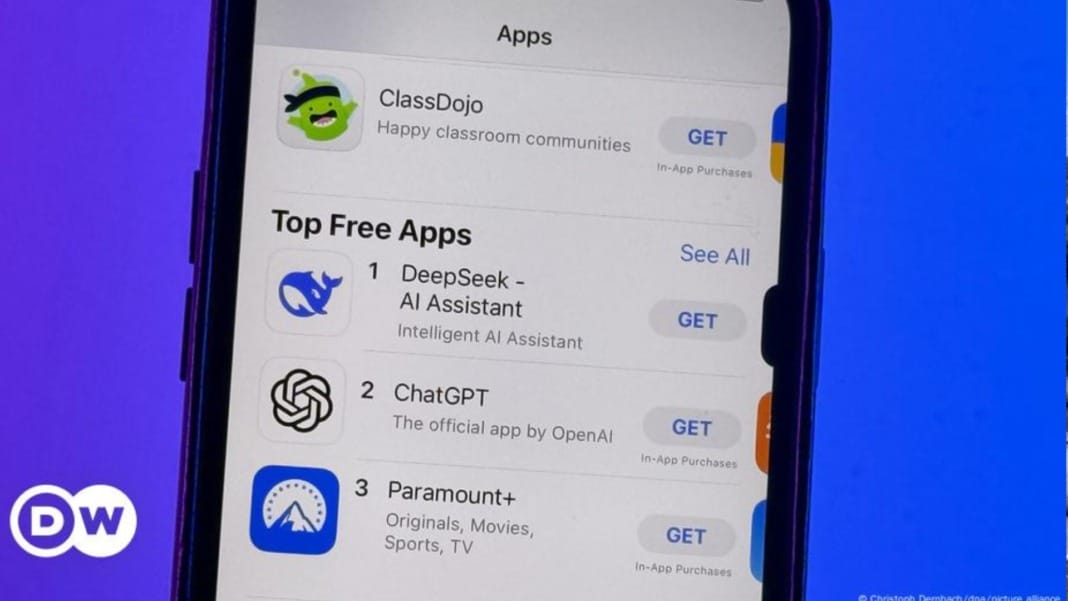

Chinese startup DeepSeek has shocked the tech world by launching its R1 AI model, which delivers performance comparable to models from giants like Google and OpenAI. However, what makes this achievement remarkable is DeepSeek’s claim of training the model with significantly fewer resources. This development could have far-reaching consequences for energy demands, data centres, and nuclear energy.

AI performance without the usual hardware demands

DeepSeek claims to have used just 2,048 Nvidia H800 GPUs over two months to train an earlier version of its R1 model. This is a fraction of the resources rumoured to be used by companies like OpenAI. The implications are profound: if AI models can achieve top-tier performance without massive hardware investments, it could upend expectations for data centre expansion and energy consumption.

Data centres are projected to use 12% of all electricity in the United States by 2027—more than triple their share from 2023. Tech companies have been scrambling to secure reliable energy sources, with nuclear power emerging as a key player. Google has agreed to purchase 500 megawatts of nuclear capacity from Kairos, while Amazon led a US$500 million investment in X-Energy. Microsoft also backs a US$1.6 billion nuclear reactor renovation at Three Mile Island.

But DeepSeek’s innovation raises the question: is the anticipated energy surge from AI overestimated?

Could efficiency curb the nuclear renaissance?

Nuclear energy has long been touted as a solution for growing electricity needs, particularly with advancements in reactor designs making it safer and potentially cheaper. However, nuclear remains costly compared to wind, solar, and natural gas, and the commercial viability of next-generation reactors has yet to be proven.

The recent AI-driven power rush changed the equation. Tech companies bet heavily on securing energy to fuel AI growth, yet DeepSeek’s breakthrough suggests there may be brute-force hardware alternatives.

Some experts remain sceptical of DeepSeek’s claims. Citigroup analyst Atif Malik commented, “While DeepSeek’s achievement could be groundbreaking, we question the notion that its feats were done without advanced GPUs.” Even so, history shows that efficiency gains in software are often more achievable than building new power plants.

If more efficient AI models become the norm, tech companies might scale back their energy investments. Historically, software solutions have always been preferred over expensive physical infrastructure.

What this means for the energy sector

Nuclear startups and other power producers could face added pressure if AI energy demands level off. Renewable energy, already cheaper and more modular, may continue outpacing nuclear and natural gas. Wind, solar, and battery technologies can be deployed in phases, offering faster returns and more flexibility than the long timelines required for nuclear reactors.

Still, electricity demand isn’t going away. The world’s shift to electrification—from electric vehicles to renewable grids—ensures that energy needs will grow regardless of AI trends. However, nuclear and gas projects could face stiff competition unless they can deliver electricity competitively.

The AI boom has already rewritten the playbook for the tech and energy industries. Whether DeepSeek’s efficiency marks the start of a broader trend or proves to be an anomaly, the next few years will reveal which bets pay off. For now, energy and tech firms are left navigating an uncertain but exciting landscape.