One of the significant hallmarks of the first two decades of the 21st century is the evolution and disruption of the business space. Phrases like ‘startup’ and ‘entrepreneur’ have entered common parlance with surprising speed due mainly to their operations integrating technology from the outset. From Google and Facebook to Airbnb and Uber, the last 20 years have seen an extraordinary change as these companies rapidly exploded in the marketplace to become multi-billion dollar corporations.

While these startups’ ecosystem is recognized as having an infrastructure of technology, it’s the economic backdrop of their founding that’s incredibly fascinating. Periods of mass growth and innovation often occur in tandem with economic downturn and recovery, so it’s no surprise that many of the power players of the 21st century were founded around the Great Recession or in the years of massive growth afterward. Even when we go further back, companies like Disney, Microsoft, and Hewlett & Packard were all founded around periods of economic uncertainty and, as we know, have gone on to flourish and expand.

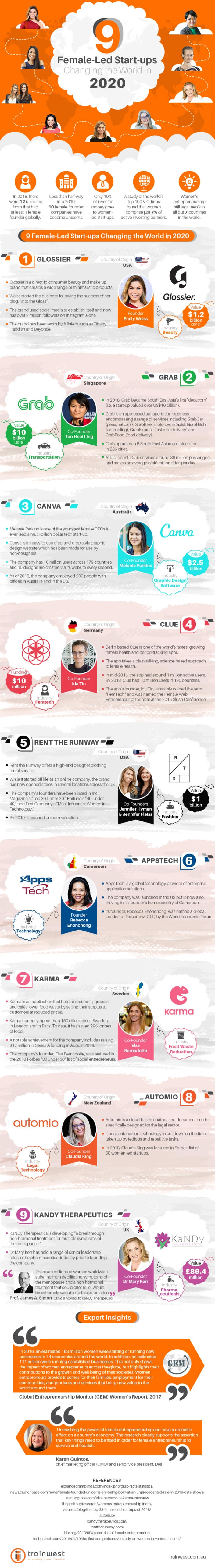

The rise of female-led ‘unicorn’ startups

Within this startup space, it seems that the next era will be defined by the rise of female-led and female-founded companies. This is an asset class that’s mostly been overlooked and underfunded, whether it’s due to the culture of Silicon Valley and other startup meccas or because of venture capitalism practices. Shifts since 2015 have shown a steady trend towards startups with female founders and owners being invested in well above and beyond the years prior. Moreover, these startups are considered to be leading the charge in a “pink-winged stampede,” with an unprecedented number of them reaching a billion-dollar ‘unicorn’ valuation in the last five years. In 2019 alone, 21 female-led startups surpassed the US$1 billion mark.

Equally, this trend speaks a lot to how much change is brewing in the startup space and how behavioral shifts in venture capitalism promise even more disruption to investors and the market itself. It can’t be ignored that gender biases in funding previously existed with venture capitalists yet the recent years of change indicate that the shift now is based on performance figures rather than unfounded prejudices. Natasha Mascarenhas writes for Crunchbase News about the trend of venture capitalists intentionally prioritizing investing in female-led startups, “It’s not about gender, it’s about being a capital-focused operation, comprised of investors wanting returns.”

The dynamics of data and investment return

The specifics of data around investment performance is worth discussing for several reasons. From a context standpoint, female-led startups already make their mark when looking at the ratio of overall investment dollars versus the proportion of startup classes as ‘unicorns.’ Beyond the Billion reports that although female-led startups make up 4% of all unicorns in 2020, they received only slightly more than 2% of all venture funding in the years leading up to this. These female-led startups are vastly overrepresented in the ‘unicorn’ club despite the comparatively low proportion of total investment dollars.

The figures on the return of investment dollars are significant, with one study investigating the comparative revenue generated from female-run startups to male-run startups. The study from 2018 Boston Consulting Group study showed that a female-run startup averaged revenue of US$0.78 for every US$1 of investment raised, whereas a male-run startup only averaged revenue generation of US$0.31 for every US$1 of investment – ‒ a difference of 50%.

Susana Robles, a Venture Partner and Executive Advisor, breaks down this growth potential, investment return, and overall repayment of investments with even more forensic detail. She says in an interview with Techcrunch, “Women tend to return money to investors faster than men, and at the same time, they obtain higher returns. Women are in charge of 64% of all global purchasing decisions on products and services, so having women on C-level positions increases the chance that a startup [will] be highly attractive to a massive market and become a unicorn.”

Looking forward: Female-led startups to know about in 2020 and beyond

The infographic round-up below explores nine of the most influential and groundbreaking ‘Female-Led Startups Changing The World in 2020’. Training and education experts Trainwest analyzed these companies and their offerings to develop this resource that delves into the asset class in more detail. From a range of perspectives, female-led startups are a significant growth area in business, not least when considering their return on investment and their holistic impact within industries and civic spaces. Read on for the full graphic guide and learn more about these startups in terms of their unique selling proposition, founding story, value or reach, and startup significance.