AMD announced its second-quarter 2024 earnings today, revealing a significant shift in its business. Nearly half of AMD’s sales now come from data centre products, departing from its traditional focus on personal computer chips, game consoles, and embedded chips for industry or vehicles.

A growing focus on data centres

AMD’s data centre business has seen remarkable growth, doubling in a year. This quarter’s success is mainly attributed to the AMD Instinct MI300 accelerator, a competitor to Nvidia’s highly influential H100 AI chip. AMD’s MI300 achieved over US$1 billion in sales in just one quarter, a significant increase from its previous milestone of US$1 billion in cumulative sales since its launch in December 2023. Additionally, AMD’s Epyc server CPUs have contributed to this growth.

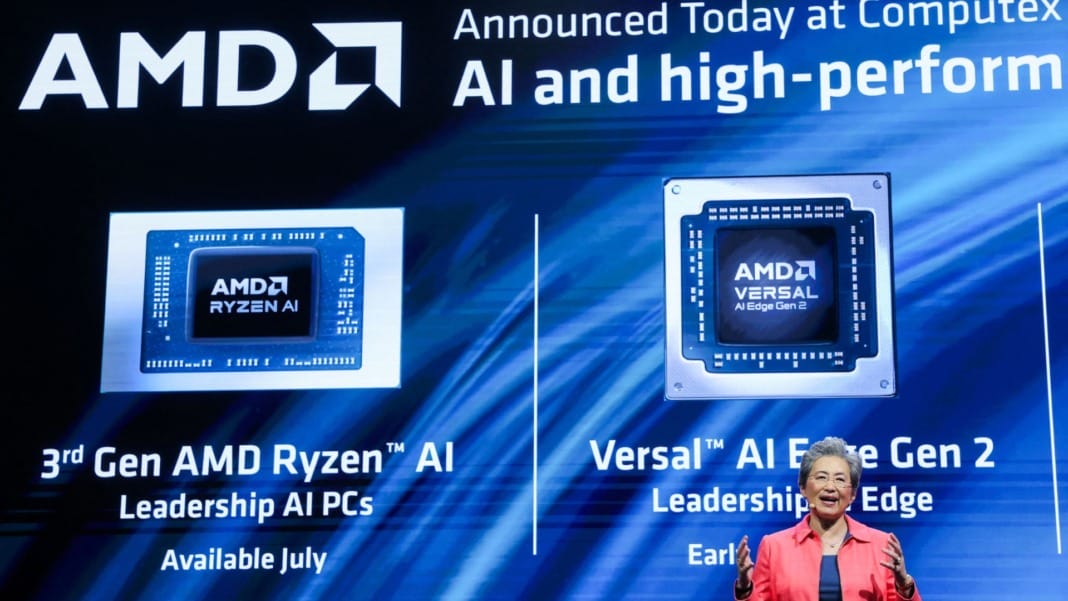

This strategy mirrors Nvidia’s approach, which has seen substantial profits from its H100 chip. Nvidia plans to release new AI chips annually, focusing on research and development to maintain its market lead. AMD is adopting a similar strategy and planning to release new AI chips yearly. The MI325X is scheduled for the fourth quarter of this year, followed by the MI350 in 2025 and the MI400 in 2026. According to CEO Lisa Su, the MI350 is expected to be “very competitive” with Nvidia’s Blackwell, which was revealed in March as “the world’s most powerful chip” for AI and has recently started sampling to buyers.

Despite supply chain improvements, Su indicated that the supply of the MI300 will remain tight through 2025. With its significant headstart, Nvidia still dwarfs AMD in the data centre market. Nvidia reported US$22.6 billion in data centre revenue for the quarter, compared to AMD’s US$2.8 billion.

Impact on PC gamers and other markets

This shift towards AI may have mixed implications for PC gamers and other consumers looking for new chips. On the one hand, advancements in AI chip technology could trickle down to improve consumer GPU architectures, potentially accelerating performance improvements. However, in 2024, the intense focus on AI chips means fewer new GPUs for gamers may exist.

Nevertheless, AMD’s computing CPU and GPU businesses have shown resilience. Ryzen CPUs saw a 49 per cent year-over-year increase and a slight quarter-over-quarter rise. Despite a 59 per cent decline in gaming revenue due to reduced PlayStation and Xbox sales, AMD reported a rise in sales of its Radeon 6000 GPUs year over year.

Upcoming products and future outlook

If you’re wondering about the availability of AMD Zen 5 laptops, AMD assures that more than 100 different platforms are set to ship with its Ryzen AI 300 “Strix Point” chips. While only Asus models have hit the shelves so far, along with a single HP announcement and an MSI preview, Su confirmed that Acer and Lenovo will also offer these laptops soon.

As AMD continues to pivot towards AI, the company is poised to become a significant player in the data centre market, challenging Nvidia’s dominance. This shift marks a new chapter for AMD, with a strong focus on AI technology driving future growth.