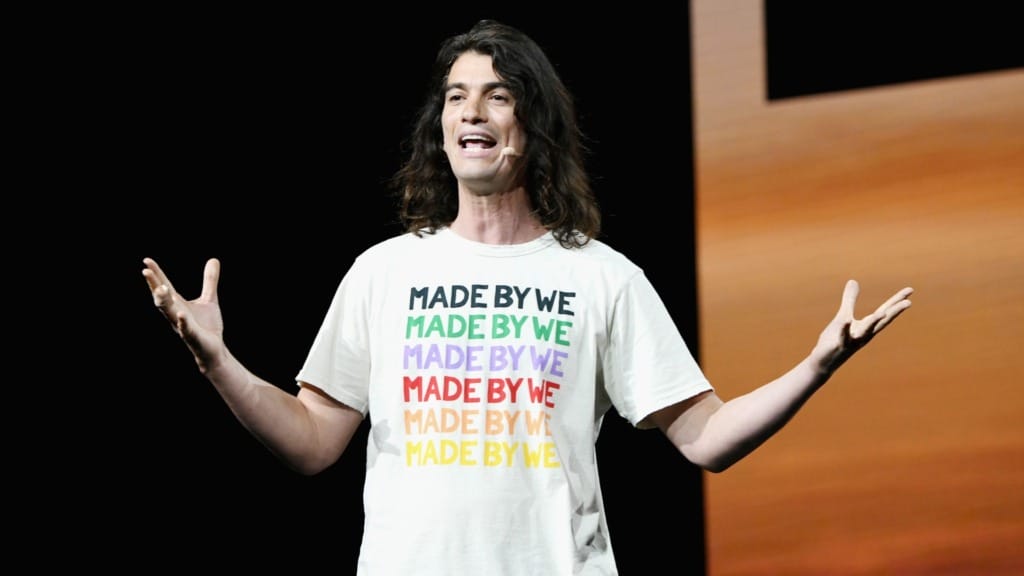

Adam Neumann, the charismatic co-founder of WeWork, is making waves yet again in the business world, this time with his audacious attempt to repurchase the embattled company amidst its bankruptcy proceedings. Reports swirling around the corporate landscape suggest that Neumann, in collaboration with his latest venture, Flow Global Holdings LLC, is marshalling resources and forging alliances with investors such as Third Point, spearheaded by the renowned hedge fund manager Dan Loeb, in a bold bid to regain control of the once-revolutionary workspace provider.

Hurdles along the way

Neumann’s legal representatives have aired their grievances publicly, expressing dismay over what they perceive as WeWork’s uncooperative stance in providing essential information vital to the buyback endeavour. They have shed light on Neumann’s efforts in October 2022 to secure a staggering sum of up to US$1 billion in financing to stabilise WeWork’s turbulent financial situation. However, these efforts were abruptly halted by none other than the former CEO himself, leaving many scratching their heads in bewilderment.

The rise and fall of WeWork

The saga of WeWork’s rise and fall has captivated the attention of the global business community. Once a darling of Silicon Valley, the company soared to stratospheric heights, boasting a valuation that soared to an eye-watering US$47 billion at its peak. However, the euphoria surrounding WeWork’s meteoric ascent was short-lived, as cracks emerged in its ambitious growth strategy. The company’s aggressive global expansion led to a sprawling portfolio of properties, many of which failed to meet expectations, resulting in significant financial strain.

The nadir came in November of last year when WeWork was forced to file for bankruptcy, revealing staggering debts totalling over US$18.6 billion. The filing marked a stunning reversal of fortune for the once high-flying startup, which had attracted investments from heavyweights such as SoftBank, BlackRock, and Goldman Sachs, among others. The company’s descent into bankruptcy was a stark reminder of the perils of unchecked ambition and rapid expansion, serving as a cautionary tale for aspiring entrepreneurs and seasoned investors alike.

Responses and reactions

In response to Neumann’s ambitious bid to reclaim control of the company he helped build, WeWork has remained tight-lipped, offering a terse statement acknowledging the receipt of expressions of interest from external parties. The company asserted that it would evaluate such proposals to act in the best interests of the company, hinting at the complex negotiations and deliberations taking place behind closed doors.

Meanwhile, Third Point, one of the potential investors involved in the discussions, has sought to temper expectations, emphasising that any involvement in a possible transaction is contingent upon thorough due diligence and careful consideration of the proposed terms. The hedge fund has clarified that it has engaged in only preliminary discussions with Neumann’s Flow regarding their vision for WeWork’s future, stopping short of committing to any concrete course of action at this stage.

Neumann’s latest venture, Flow Global Holdings LLC, represents a departure from his previous foray into coworking spaces, focusing instead on the residential real estate sector. Backed by heavyweight investors such as Andreessen Horowitz, the venture received a significant injection of capital in August 2022, signalling confidence in Neumann’s ability to navigate the complexities of the property market.

The future of WeWork

If successful in his bid to repurchase WeWork, Neumann’s triumph would mark a remarkable comeback for the enigmatic entrepreneur, who was unceremoniously ousted from the company amidst mounting scrutiny over his leadership and governance practices. It would also pave the way for a new chapter in the company’s history as it seeks to chart a course towards financial stability and sustainable growth in a post-pandemic world.

Adam Neumann’s ambitious bid to reclaim WeWork amidst its bankruptcy proceedings represents a compelling chapter in the company’s tumultuous journey. As negotiations unfold behind closed doors, WeWork’s fate hangs in the balance, with stakeholders eagerly awaiting the outcome of this high-stakes corporate drama.