After 24 years of fostering business relationships between the U.S. and China, the venture capital firm GGV Capital has divided its operations, introducing two new brands: Granite Asia and Notable Capital. This strategic move, occurring six months after the initial announcement of the split, marks a significant shift in the firm’s approach amidst the evolving U.S.-China relations.

Granite Asia emerges in Singapore

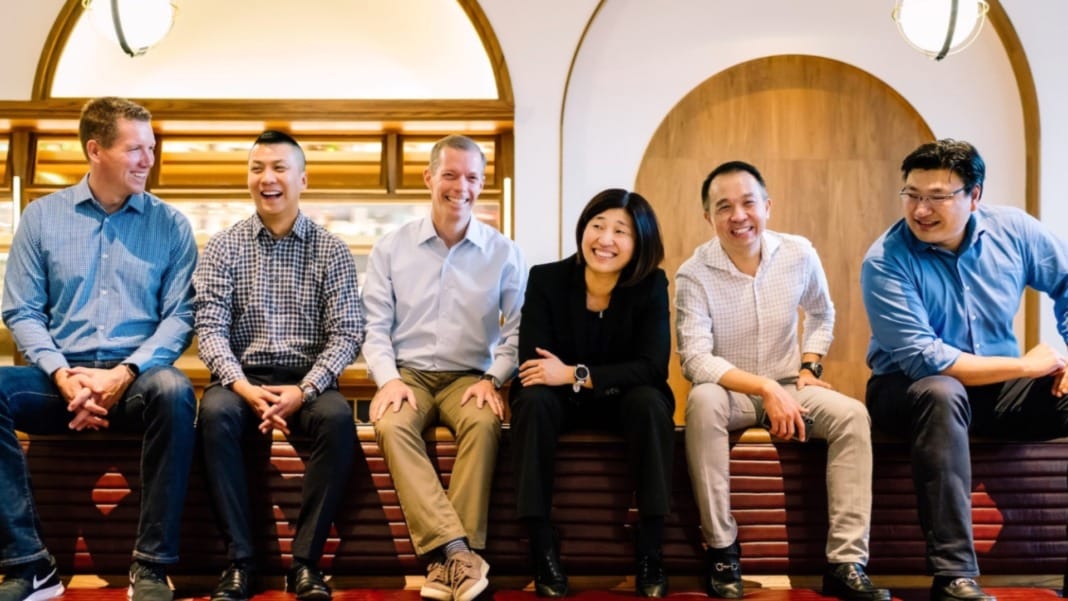

Jenny Lee and Jixun Foo, seasoned investors from Singapore, have launched Granite Asia. This new entity, as reported by Forbes, aims to continue the legacy of GGV Capital by focusing on investments in China, Japan, South Asia, Australia, and Southeast Asia. Lee, known for her influential presence on Forbes’s Midas List and her successful investments, including Xiaomi and Kingsoft WPS, partners with Foo, recognized for his impactful deals such as Xpeng Motors and Didi. Granite Asia’s leadership signifies a strong foundation in the venture capital landscape, ready to nurture startups across various sectors in the Asia-Pacific region.

Notable Capital takes the helm in the U.S.

To Day 1 again 🙏🚀💗. Thank you all for sending me and my partners your well wishes throughout the day today, 3/29/2024. excited about whats ahead and the opportunity to back notable founders, ideas, and causes who make positive differences in our lives. https://t.co/asRyD4fd0f

— Hans Tung (@hanstung) March 30, 2024

On the other side of the globe, Hans Tung, a co-founder of GGV Capital based in the Bay Area, introduced Notable Capital on X. This new venture aims to sustain GGV Capital’s investment ventures in the U.S., Europe, and Latin America. Tung, along with Jeff Richards and Glenn Solomon, who have made significant investments in companies like Airbnb, Coinbase, and Opendoor, will lead Notable Capital. This team of seasoned investors represents a deep commitment to fostering innovation and supporting startups across a diverse range of industries.

A strategic split amidst geopolitical tensions

The decision to split GGV Capital into two distinct brands comes in the wake of growing U.S.-China tensions. Although not explicitly stated as the primary reason for the separation, the geopolitical climate has undeniably influenced the venture capital landscape. This strategic move mirrors actions taken by other firms, such as Sequoia Capital, which also restructured its operations last year to navigate these challenges effectively. The creation of Granite Asia and Notable Capital reflects a proactive approach to adapt to the changing dynamics of global investments, aiming to leverage the strengths and expertise of their respective teams in different regions.

As GGV Capital transitions into Granite Asia and Notable Capital, the original firm’s legacy lives on through its experienced leaders and their vision for the future. With a collective management of nearly US$9.2 billion in assets, both new entities are poised to make significant impacts in the venture capital realm, continuing to support startups and innovations across the globe.